The Private Equity industry is experiencing tremendous growth. With that growth brings increased competition and operational challenges.

Leveraging modern technology to scale efficiently and manage critical processes are keys to a GP’s success.

Background

Modern technology and industry maturity (i.e. Fund Administrators and other Service Providers) provide a number of options for Private Fund Managers to streamline operations, minimize overhead costs, and scale assets. However, relative to other industries, investment into data management and workflow solutions continue to lag behind. Some may point to the relative success of Private Fund Managers over the past few economic cycles as evidence that more investment in these areas is unnecessary. However, in recent years, changing market conditions and increased scrutiny from investors and regulators indicates a need for greater process oversight and access to granular data.

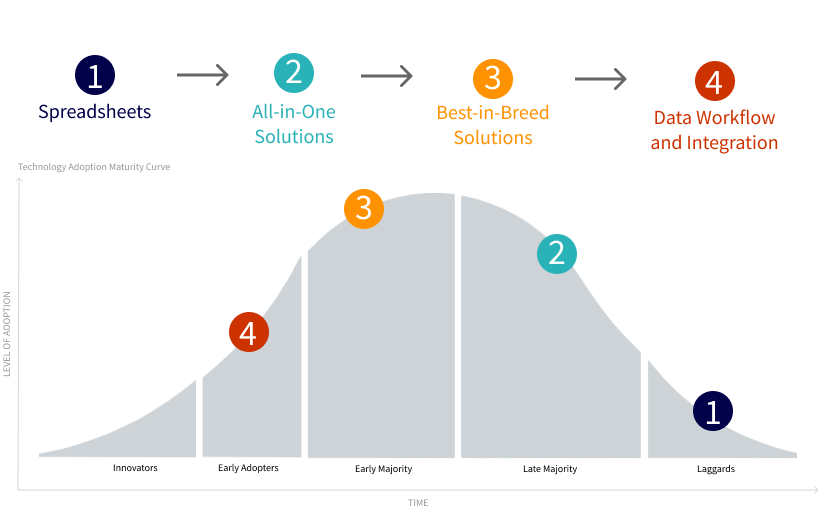

While some technology providers tout an end-to-end or front-to-back suite of solutions, many Fund Managers elect to deploy best-in-breed solutions tailored to fit specific needs. While this brings an effective solution to the specific problem, it also creates data siloes and necessitates manual reconciliation between systems to ensure every stakeholder has access to the most accurate, complete, and timely data.

Phases of Private Capital Technology Maturity

Added to the stresses in the data ecosystem is the prevalence and growth of outsourced services for Private Fund Managers. Third Party Fund Administration has alleviated many challenges (staffing requirements, burdensome technology and reporting demands) but introduced new ones (oversight, workflow collaboration, data integration, etc.). Additional third party services ranging from PortCo data to valuations to treasury management further complicate matters.

The Exchangelodge Solution

SCALE

EFFICENCY

DATA QUALITY

CONTROL & GOVERANCE

Exchangelodge was built to solve some of the biggest challenges facing Private Fund Managers, tackling large data volumes and complex processes. With our industry specific, intelligent workflow and data management solutions, all systems and providers are connected, all data is rigorously validated, and all data workflows are automated. With Exchangelodge, you can improve data conviction and execute on your business goals with scale and precision.

Playbook for Fund Managers

Increase efficiency and manage critical workflows with ready-to-use templates

Administrator Oversight

Eliminate manual review by automating the validation of core accounting data

Port Co Data Exchange for Direct Investments

Optimize portfolio company data to eliminate errors and omissions

Data Integration as a Service

Out-of-the-box connectivity to industry-specific niche solutions